How to send international payments for business cheaply

Sending money across borders is frequently necessary for startups and small to medium-sized businesses (SMBs), but it may also be expensive and challenging. International payments might involve hidden costs, slow processing times, and unfair currency exchange rates, whether you're paying partners, suppliers, or independent contractors abroad. Fortunately, these transactions may now be completed more quickly, affordably, and transparently thanks to modern financial technologies.

Challenges with Traditional International Payments:

To send money abroad, a lot of firms and SMBs use standard bank wire transfers. Although banks offer security, their cross-border payment services typically have high costs, ranging between $40 and $50 per transfer, as well as additional fees for receiving and transferring services. Additionally, banks frequently provide less favourable currency exchange rates, which might result in additional hidden expenses of 2-3%. These fees and rate markups can easily add up to 3-5% of the overall payment value, which is money that would be better used for other business investments. Furthermore, the completion time for bank transactions can range from 1-5 working days. These delays may cause operational issues or postpone payments to important partners for startups and SMBs with limited financial flows. The payment procedure is further complicated by the absence of transparent tracking.

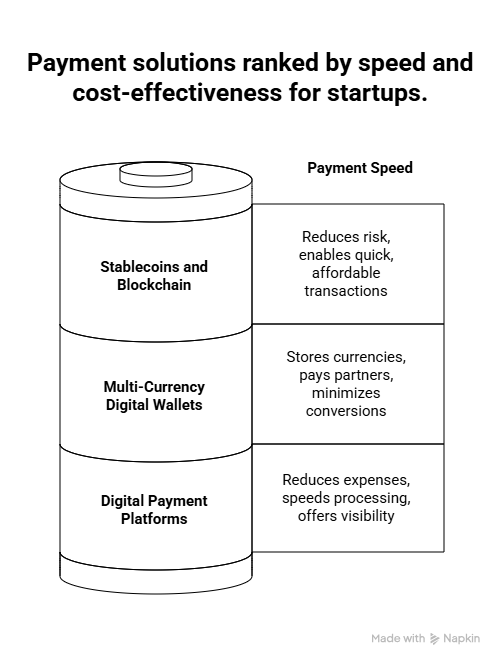

New Alternatives for Startups and SMBs: Digital payment platforms and fintech companies have created solutions specifically designed to meet the demands of smaller enterprises. These choices cut expenses, speed processing, and offer transparent payment visibility.

How Stablecoins and Blockchain Work in Cross Border Payments

Stablecoins are digital currencies pegged to stable assets such as the US dollar or the euro. This price stability removes the volatility typically associated with cryptocurrencies, making stablecoins well suited for cross border payments and international business transactions.

Stablecoin payments operate on blockchain networks, which are distributed ledgers that securely and transparently record transactions. Popular blockchains such as Ethereum, Binance Smart Chain, and Solana support programmable smart contracts. These allow payments to be processed automatically, without banks or other intermediaries, at a lower cost and higher speed.

Using stablecoins, startups and businesses can send international payments directly to a recipient’s digital wallet within minutes. This avoids traditional banking delays, reduces international transfer fees, and removes unnecessary correspondent banking layers. Funds can be converted from local fiat currency into stablecoins and, after settlement, converted back into local currency by the recipient at a lower FX cost.

Multi Currency Digital Wallets for Businesses and Startups

Multi currency digital wallets allow startups and SMBs to store, manage, and send multiple currencies, including fiat currencies and stablecoins, from a single platform. This simplifies international payments and reduces repeated currency conversions, which are a major source of hidden foreign exchange costs.

These wallets enable businesses to pay global suppliers, contractors, and partners in their preferred currencies while maintaining better control over cash flow. Many modern multi currency wallets combine regulated financial infrastructure with blockchain based payment rails. This hybrid model delivers faster settlement, lower cross border payment fees, and improved transparency, making it well suited for growing international businesses.

Security, Compliance, and Risk Management

Security is critical for startups and SMBs operating with limited financial buffers. Blockchain technology provides strong security features, including cryptographic verification and immutable transaction records, which help prevent fraud and transaction manipulation.

In addition, reputable international payment platforms comply with regulatory requirements such as Know Your Customer (KYC) and Anti Money Laundering (AML) standards. These controls ensure that stablecoin and multi currency payments remain compliant, secure, and legally sound across different jurisdictions.

How Platforms Like Endl Help Here: Endl is an example of a finance platform that provides these features. It provides companies with multi-currency wallets that support both traditional currencies and stablecoins, making international payments faster and more cost-effective. It hopes to lower costs and processing times while preserving security and regulations by combining blockchain technology with conventional banking systems. Fintech innovation may help startups and SMBs better manage cash flow and lower transaction costs by assisting them in navigating the complexity of international payments, as demonstrated by Endl.

Benefits for Startups and SMBs: For example, if a US-based firm pays an international freelancer €1,000 a month, employing traditional techniques could result in delays of several days and over $60 in bank costs. Stablecoin payments made using digital wallets can save money and speed up cash flow by lowering costs to less than 1% and completing transfers in a matter of hours.

Tips for Cost-Effective International Payments

- To reduce fees and prevent frequent conversions, use multi-currency wallets.

- Study blockchain and stablecoin payment methods, particularly for frequent transactions. To find the greatest offers, often compare charge schedules and currency rates.

- Select payment companies that give great assistance, real-time tracking, and transparency.

- For easier adoption, educate your staff and foreign partners on these new payment options.

- Verify that suppliers agree to security and compliance requirements to safeguard your money.

Slow, expensive, and complex international company payments are no longer necessary. Startups and SMBs can maximize payments for speed, cost, and transparency by embracing fintech innovations and digital currency possibilities. This will give them more confidence to expand internationally.

Citations

- World Bank. Remittance Prices Worldwide.https://remittanceprices.worldbank.org/

- Statista. Cross-Border Payment Fees and Fintech Trends, 2025.https://www.statista.com/topics/871/online-payments/

- CoinDesk. "Stablecoins in business payments growth."https://www.coindesk.com/business/stablecoins-payments/

- Endl.io. "Multi-currency wallets for SMB international transfers."https://www.endl.io/business

FAQs

Q1: What are the typical costs of traditional bank wire transfers?

Traditional international bank wires usually cost USD 40 to 50 per transaction, plus foreign exchange markups of around 2 to 3 percent. Combined, this often results in total costs of 3 to 5 percent of the payment value, with settlement delays ranging from one to five business days.

Q2: How do stablecoins reduce international payment costs for businesses?

Stablecoins such as USDC remove correspondent banks and reduce FX spreads. Payments typically settle within minutes, with transaction fees usually under 1 percent, making them far more cost-efficient than traditional cross-border payments.

Q3: Why are multi-currency wallets ideal for SMBs and startups?

Multi-currency wallets allow businesses to hold fiat currencies and stablecoins in one place. This enables payments in a supplier’s preferred currency, reduces unnecessary currency conversions, improves cash flow management, and lowers overall international payment costs.

Q4: Are blockchain payments secure for business use?

Yes. Blockchain payments use tamper-resistant ledgers and cryptographic security. When combined with regulated platforms that follow KYC and AML requirements, such as Endl, they offer a secure and compliant option for international business payments.

Q5: How much can businesses save using Endl for a €1,000 freelancer payment?

With traditional bank transfers, businesses may face delays of several days and fees exceeding €60. Using Endl, the same payment can settle within hours, with fees under 1 percent, resulting in cost savings of over 90 percent.

Q6: Which blockchain networks are best for business payments?

Ethereum, Binance Smart Chain, and Solana are widely used for business payments. They support smart contracts, offer fast settlement, and enable low-cost cross-border transfers suitable for startups, SMBs, and global e-commerce companies.